Key Takeaways:

- Understanding the different types of dental insurance plans

- Essential factors to consider when choosing a dental plan

- How to balance cost with benefits for your employees

- The role of dental insurance in employee satisfaction and retention

Introduction: The Importance of Dental Insurance

In today’s competitive job market, offering comprehensive benefits, including dental insurance, is critical for small businesses. It enhances employee satisfaction and helps attract and retain top talent. But with numerous dental insurance plans available, how do you choose the right one for your business?

This article aims to help small business owners navigate the confusing world of dental insurance by outlining essential considerations and the advantages of offering such coverage to staff members.

Types of Dental Insurance Plans

Dental insurance for small businesses is an essential aspect of employee benefits packages. Understanding the different dental insurance plan types is crucial to making an informed decision. Generally, dental insurance plans fall into four main categories:

- Preferred Provider Organization (PPO) Plans

PPO plans are popular because they offer flexibility. Employees can choose any dentist, but they will save more if they select a dentist within the insurance company’s network. These plans usually cover a percentage of the costs for procedures, with different levels of coverage for preventive, primary, and primary services.

- Health Maintenance Organization (HMO) Plans

HMO plans, also known as Dental Health Maintenance Organizations (HMOs), generally have lower premiums than PPO plans. However, they require employees to choose a primary care dentist from the plan’s network and need referrals for specialists. These plans often have low or no deductibles, but the trade-off is less flexibility in choosing providers.

- Indemnity Plans

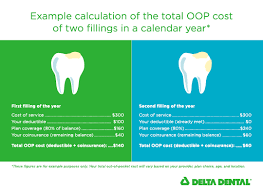

Indemnity or fee-for-service plans offer the most freedom in choosing any dentist. The insurance company pays a set percentage of the charges for any service, and the employee pays the rest. While these plans provide great flexibility, they often incur higher out-of-pocket costs and require employees to pay upfront and wait for reimbursement.

- Discount or Referral Dental Plans

These are not insurance plans but rather offer discounts on dental services. Workers can access a network of dentists that provide services at discounted prices by paying an annual fee. While these plans can save money on dental care, they don’t cover any costs, requiring employees to pay out of pocket for each service.

Factors to Consider When Choosing a Dental Plan

Selecting the right dental insurance plan for your small business involves balancing costs with benefits. Here are some factors to consider:

- Premium Costs

Premiums are the regular payments made to keep the insurance active. Assess the affordability of premiums for your business and your employees. Some plans have low premiums but higher out-of-pocket costs for employees, while others might have higher premiums that cover more services.

- Coverage Details

Review the types of services covered under each plan. Generally, plans categorize services as preventive, primary, or significant. Ensure the plan offers comprehensive coverage for preventive care to avoid substantial treatments later. Some plans also cover orthodontics, a substantial consideration for employees with children.

- Network of Providers

The size and accessibility of the dental provider network are crucial. A more extensive network gives employees more choices and convenience. Check if the plan’s network includes reputable dentists in your area. Plans with smaller networks might limit your employees’ options and affect their satisfaction with the benefits.

- Employee Needs

Understanding your employees’ needs is essential. Conduct a survey or hold meetings to discuss their value in dental coverage. If many employees have families, a plan that covers orthodontics and pediatric dentistry might be more suitable. A PPO plan might be better if employees prefer flexibility in choosing their providers.

Balancing Cost and Benefits

Cost is always a significant factor for small businesses. However, it’s essential to consider the value derived from the investment in dental insurance. Here’s how to balance costs with benefits:

- Preventive Care Focus

Choose a plan that emphasizes preventive care. Preventive services like cleanings and exams are often covered at 100%, which helps employees maintain their oral health and avoid costly procedures. By prioritizing preventive care, you can reduce the long-term costs associated with dental issues.

- Cost-sharing Strategies

Consider cost-sharing strategies where the business and employees contribute to the premium costs. This can make offering dental insurance more feasible. You could also offer different plans at various prices, allowing employees to choose what fits their needs and budgets best.

- Tax Advantages

Offering dental insurance can provide tax benefits for your business. Premiums paid by employers are generally tax-deductible, and contributions made by employees can be pre-tax if provided through a Section 125 plan or cafeteria plan. These tax advantages can offset the cost of delivering dental insurance.

The Role of Dental Insurance in Employee Satisfaction and Retention

Employees appreciate comprehensive benefits packages that include dental insurance. Providing dental coverage shows that you care about their overall well-being, which can enhance job satisfaction and loyalty. Dental benefits can be a deciding factor when job candidates evaluate job offers, especially in a competitive market.

Investing in the health of your staff is an investment in your company’s success. Employees in better health are more likely to stay on the job longer, be more productive, and take fewer sick days. Employee engagement and motivation are also higher when they feel appreciated and cared for, which benefits the company’s culture and financial performance.

Conclusion: Making an Informed Decision

Choosing the right dental insurance plan for your small business requires careful consideration of cost, coverage, and employee needs. By being aware of the various dental insurance plans and weighing the previously mentioned factors, you can make an informed choice to help your company and its employees.

Investing in dental insurance for small businesses enhances employee satisfaction and retention and promotes overall health and productivity. Selecting a dental plan wisely can add significant value to your benefits package and aid in luring and keeping top talent in a cutthroat labor market.